SURCHARGE SOLUTIONS

This is great news for non-profits, municipalities, school lunch and government programs that can not afford to pay these fees. By passing the fee onto the consumer, merchants can offset the cost of credit card processing, saving valuable time, money and resources.

Benefits of TRX Surcharge Solutions

- Fully compliant solutions

- Pass credit card processing fees on to the consumer

- Save money and resources.

TRX SURCHARGE

MOBILE PAYMENTS

Take Customer Payments Easily With The TRX Mobile Platform

Payments are now easier than ever, with the TRX Mobile Platform. Simply download the TRX App to your mobile device, register with Transaction Services, connect the card reader… and you’re all set!

ACCOUNT UPDATER

Keep Customers Satisfied and Reduce Churn

The innovative TRX Account Updater automatically updates payment details in your software platform for customers who may have ongoing subscriptions, member profiles or other recurring purchases where payment methods have been stored.

- Reduces churn from expired payment information

- Safe and secure

- PCI-compliant

HOSTED PAY PAGE

Reduced security risks

No need to keep credit card numbers on file for recurring transactions. With our FREE virtual terminal, you can process payments from any web-enabled device. Our secure terminal will safely store non-sensitive customer information and use tokens to submit payments with no risk to the merchant. Now you can safely process sales and subscription payments via phone, mail order or online. Our system comes with customizable email alerts and notifications to let you and your customers know when a payment has been processed.

Benefits:

- No need for expensive SSL certificates

- Payment page maintains website branding and logo

- Reduced scope for PCI – PCI responsibilities handled by TRX

- Tokenization encryption – sensitive data no longer stored by merchant

- Quick and Easy to install

- Customizable email alerts

- Free virtual terminal

- Track information on sales and customer preferences with user defined field entry in checkout

- Create customized reports to track sales

ONLINE REPORTING

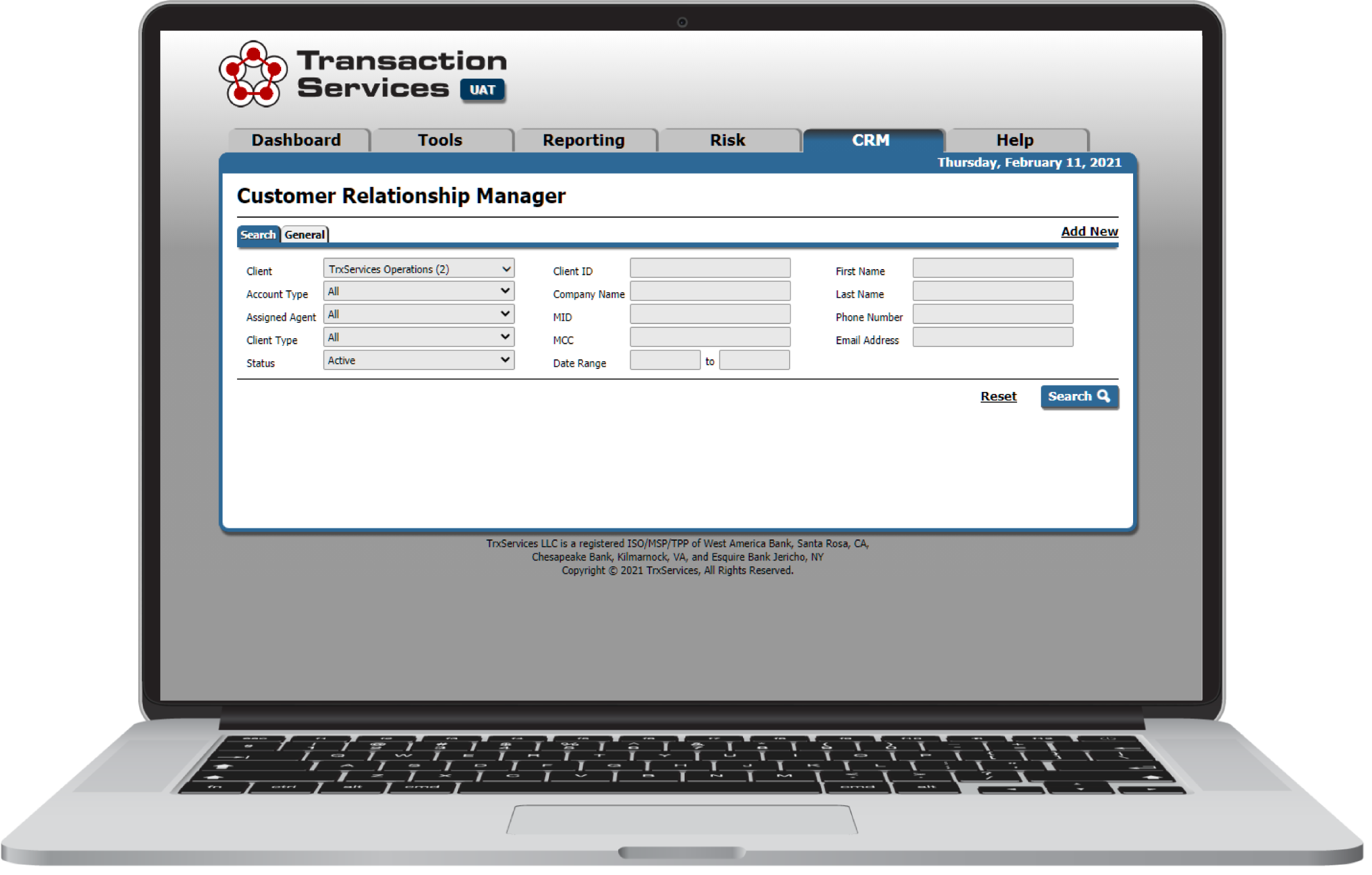

Get To Know Your Customers Better

- Detailed interchange reports

- Web console – instant access to transactions Centralized online reporting, analytics, and customer data

- Pull name from card and show in reports

- Sales reports/employee sales reports

- Send offers to existing customers about sales, discounts, and events via text or email

- Analytics

- Customer information

STORAGE SAFE

Tokens for safe transmission

StorageSafe creates a customer profile, also called a “wallet” that can store multiple instances of three types of records: Consumer, Account and Shipping records. Once a card is processed, the encrypted data is stored in our secure facility, which allows merchants to schedule recurring payments and monthly billing cycles without having to store or access sensitive cardholder data. Instead the merchant uses an ID number or token for each record to retrieve the stored data. By using the token, you can easily process the card data again for recurring transactions.

Protect yourself from PCI compliance issues sign up for StorageSafe today.

Benefits:

- No need to keep credit cards on file in your office

- PCI compliant processing

- Easily process monthly billing and recurring payments

- State of the art encryption on all transactions

PAYMENT ACCOUNT REFERENCE (PAR)

Maximize Opportunities To Identify And Reward Loyal Customers

Payment Account Reference (PAR) is a new capability that enables merchants to securely understand customers’ buying patterns when using multiple payments cards at different times with the same merchant.

PAR functionality is built into the robust TRX processing platform. With PAR, merchants can:

- Identify in real-time unique cardholders

- Build a broader CRM capability

- Enhance existing Risk/Fraud/AML prevention

- Improve their Loyalty/Rewards programs

- Drive better customer account management

VISA MERCHANT PURCHASE INQUIRY (VMPI)

Accelerate Resolutions to Disputed Transactions … Fast

Now, there is a better way to quickly resolve issues when cardholders question a transaction … Visa Merchant Purchase Inquiry … or VMPI. With VMPI, merchants can respond to cardholder questions about unknown transactions and other potential disputes … in close to real-time.

With ongoing growth in chargebacks from unrecognized transactions, and particularly from online or other digital activity, VMPI was created to help merchants, issuers, acquirers and cardholders an efficient method to identify valid transactions and avoid costly chargebacks.

How Does VMPI Work?

VMPI is a direct connection between the merchants’ transaction database

and the issuing banks using the Visa platform. The process allows merchants

to seamlessly share information to the issuers. and involves the following steps:

- Cardholder contacts their bank about a questionable transaction, and the issuer retrieves details via Visa Resolution Online (VROL)

- Visa validates if the merchant is registered for VMPI

- Visa sends a message to the merchant for additional information

- Merchant provides additional data such as order details, tracking, refund, etc.

- Merchant responds in near-real-time to the issuer

- Visa provides data to issuer, who then verifies details with the cardholder

Transaction Services is now registered for VMPI, and can help merchants resolve potential disputes and chargebacks more efficiently than ever. This capability is especially relevant and important for merchants selling products and services online and through other digital platforms.